Congress Provides M&A Brokers a Statutory Exemption from Exchange Act Registration

DOWNLOAD PDFClick “Subscribe Now” to get attorney insights on the latest developments in a range of services and industries.

On December 29, 2022, President Biden signed the Consolidated Appropriations Act, 2023 (HR 2617) (the “CAA”) into law (PL 117-328).[1] Buried within Title V of Division AA is Section 501, entitled “Registration Exemption for Merger and Acquisition Brokers.”[2] As this Client Alert explains, this new statutory provision could ultimately reshape the federal registration exemption available to merger and acquisition brokers by limiting the size of the privately-held companies they assist. The CAA does not preempt any state blue sky registration requirements for M&A brokers.

Background

Section 3(a)(4)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), defines a “broker” as “any person engaged in the business of effecting transactions in securities for the account of others.”[3] Persons who qualify as brokers must register with the U.S. Securities and Exchange Commission (the “SEC”) under Section 15(a) of the Exchange Act. In contrast, Section 15(b) sets forth the manner of such registration. Registration requirements may also apply under state blue sky laws and FINRA rules.

Ordinarily, a person engaged in effecting securities transactions in connection with the transfer of ownership and control of privately-held companies might be deemed a “broker” under the Exchange Act, particularly if such business involves the receipt of commissions or transaction-based compensation. However, in an important no-action letter from 2014 (the “M&A No-Action Letter”),[4] the staff at the SEC’s Division of Trading and Markets concluded that such an “M&A broker” need not register with the SEC under Section 15(b) of the Exchange Act as long as certain conditions are satisfied.

Since the M&A No-Action Letter was issued, it has become the definitive source of regulatory guidance for M&A brokers who wish to avoid SEC registration. Soon after the M&A No-Action Letter was issued, the North American Securities Administrators Association (“NASAA”) issued its own Model Rule providing a framework for states to enact their own M&A broker registration exemptions.[5]

The contours of the new M&A broker registration exemption included in the CAA are similar to those found in the M&A No-Action Letter. However, the new statutory exemption, which is codified as new Section 15(b)(13) of the Exchange Act, incorporates several concepts from the Model Rule as well. Under Section 501(b) of Title V of Division AA, the new statutory exemption takes effect on March 29, 2023.

Comparison of the M&A No-Action Letter and the CAA’s Statutory Exemption

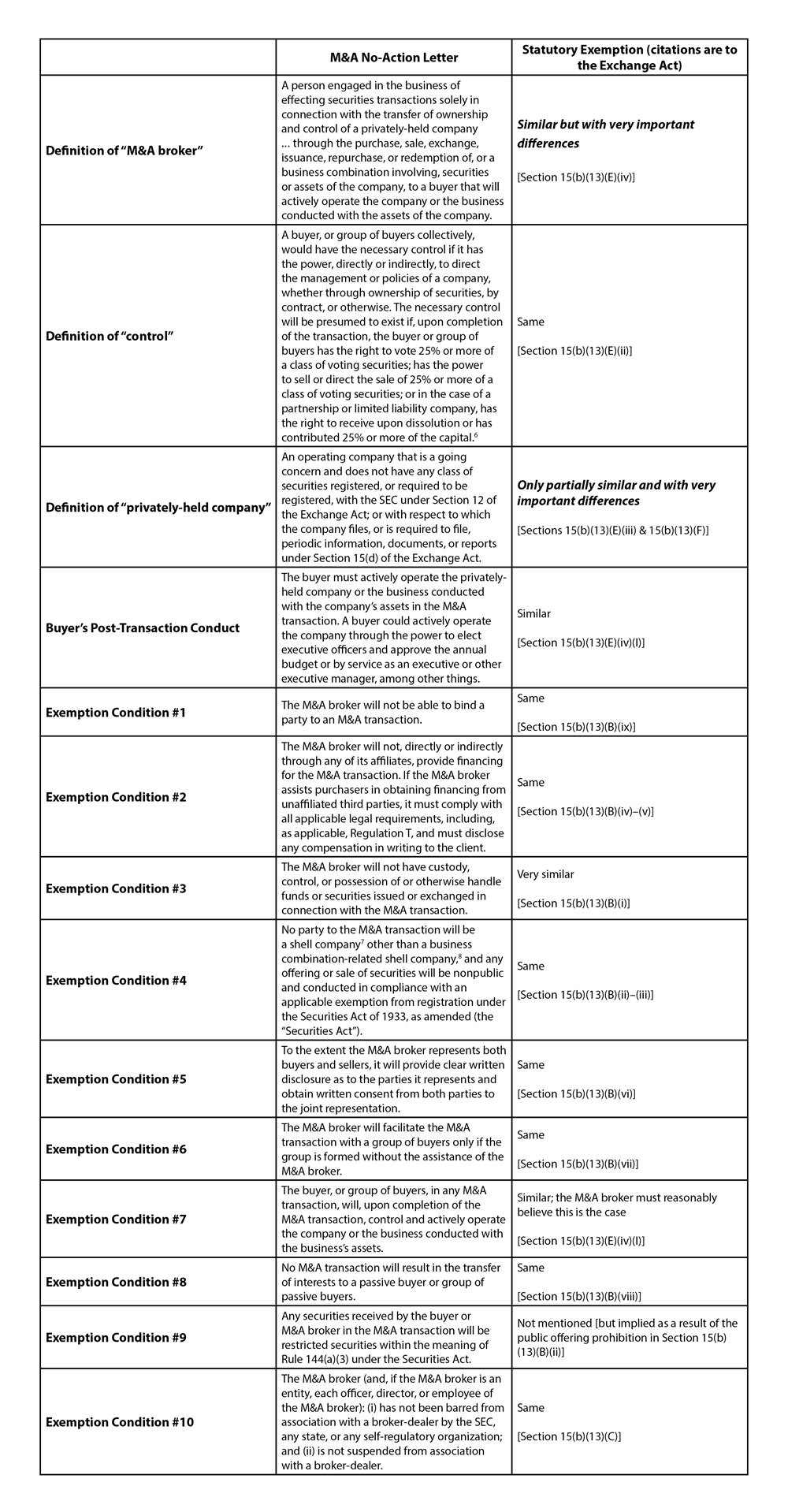

The following table summarizes the key similarities and differences between the M&A No-Action Letter and the new statutory exemption included in the CAA.

Key Takeaways

As the table demonstrates, the differences between the M&A No-Action Letter and the statutory exemption are definitional. First, the CAA defines “eligible privately held company” to exclude certain larger privately-held companies. Specifically, for the statutory exemption to be available, in the fiscal year ending immediately before the fiscal year in which the services of the M&A broker are initially engaged with respect to the M&A transaction, the privately-held company must either have EBITDA of less than $25 million or gross revenues of less than $250 million.[9] This limitation is a mirror image of the NASAA’s Model Rule. Congress authorized the SEC to later adjust these dollar thresholds for inflation every five years.

Additionally, the CAA defines “M&A broker” in such a way as to alter the definition provided in the M&A No-Action Letter. First, for the buyer’s post-transaction requirement to be active in the management of the privately-held company or the business conducted with the assets of the privately-held company,[10] the statutory exemption clarifies that the M&A broker must reasonably believe this post-transaction requirement will be satisfied.[11]

Second, the statutory exemption imposes a due diligence requirement in certain circumstances, which is another provision borrowed from the NASAA’s Model Rule. Specifically, the M&A broker must reasonably believe[12] that

if any person is offered securities in exchange for securities or assets of the eligible privately held company, such person will, before becoming legally bound to consummate the transaction, receive or have reasonable access to the most recent fiscal year-end financial statements of the issuer of the securities as customarily prepared by the management of the issuer in the normal course of operations and, if the financial statements of the issuer are audited, reviewed, or compiled, any related statement by the independent accountant, a balance sheet dated not more than 120 days before the date of the offer, and information about the management, business, results of operations for the period covered by the preceding financial statements, and material loss contingencies of the issuer.[13]

Therefore, if an M&A broker intends to rely upon the statutory exemption, this minimum level of financial disclosure will be required in connection with the M&A transaction.

At this time, it remains unclear if the SEC staff will withdraw the M&A No-Action Letter. This is important to monitor, as the M&A No-Action Letter does not limit the size of the privately-held company involved in the M&A transaction. Notably, the new statutory exemption explicitly provides that it does not limit the authority of the SEC to exempt any person from any provision of the Exchange Act.[14] Thus, until the M&A No-Action Letter is withdrawn, M&A brokers should still be able to rely on the M&A No-Action Letter if they wish to engage in M&A transactions involving privately-held companies with EBITDA exceeding $25 million and gross revenues exceeding $250 million.

In addition, it is unknown if the NASAA’s Model Rule will be modified to align with the new statutory exemption, or if states will enact new laws or promulgate new regulations to exempt M&A brokers from state registration requirements. At present, 22 states have some form of a registration exemption for M&A brokers, whether through statute, regulation, administrative order, policy, no-action letter, or interpretive opinion,[15] but these could also change in light of the new statutory exemption. Consequently, even when relying on the new statutory exemption – or the M&A No-Action Letter – to avoid federal registration, M&A brokers should also confirm that state registration is not required due to conducting M&A broker activity that is subject to the requirements of one or more states or jurisdictions.

[1] A copy of the CAA is available at: https://www.congress.gov/117/bills/hr2617/BILLS-117hr2617enr.pdf.

[2] Section 501 is found on pages 1080–1084 of the CAA.

[3] 15 U.S.C. § 78c(a)(4)(A).

[4] M&A Brokers, SEC No-Action Letter, 2014 WL 356983 (Jan. 31, 2014). A slightly revised draft of the M&A No-Action Letter was published on February 4, 2014 and is available at: https://www.sec.gov/divisions/marketreg/mr-noaction/2014/ma-brokers-013114.pdf.

[5] See Model Rule Exempting Certain Merger & Acquisition Brokers ("M&A Brokers") From Registration (Sept. 29, 2015), available at: https://www.nasaa.org/wp-content/uploads/2011/07/MA-Broker-Model-Rule-adopted-Sept-29-2015-corrected.pdf. The Model Rule does not incorporate many of the restrictions on M&A brokers' activities found in the M&A No-Action Letter or new Section 15(b)(13) of the Exchange Act.

[6] Importantly, the NASAA's Model Rule uses a lower 20% threshold for control.

[7] The term "shell company" means "a company that: (1) has no or nominal operations; and (2) has: (i) no or nominal assets; (ii) assets consisting solely of cash and cash equivalents; or (iii) assets consisting of any amount of cash and cash equivalents and nominal other assets." M&A Brokers, 2014 WL 356983 at *1 n.1. The definition under Section 15(b)(13)(E)(v) of the Exchange Act is nearly identical.

[8] The term "business combination related shell company" means "a shell company (as defined in Securities Act Rule 405) that is: (1) formed by an entity that is not a shell company solely for the purpose of changing the corporate domicile of that entity solely within the United States; or (2) formed by an entity defined in Securities Act Rule 165(f) among one or more entities other than the shell company, none of which is a shell company." Id. at *2 n.2. The definition under Section 15(b)(13)(E)(i) of the Exchange Act is nearly identical.

[9] See Exchange Act § 15(b)(13)(E)(iii)(II).

[10] See Exchange Act § 15(b)(13)(E)(iv). The Model Rule also requires the M&A broker to reasonably believe this post-transaction requirement will be satisfied.

[11] See Exchange Act § 15(b)(13)(E)(iv)(I)(bb).

[12] The NASAA's Model Rule does not include a reasonable belief requirement for this due diligence component.

[13] See Exchange Act § 15(b)(13)(E)(iv)(II).

[14] See Exchange Act § 15(b)(13)(D).

[15] These jurisdictions include Alaska, Arkansas, California, Colorado, Florida, Georgia, Illinois, Iowa, Maryland, Michigan, Mississippi, Montana, Nebraska, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, and Vermont.

Related Practices

Contacts

Recent Insights

- June 30, 2025 In the News Two Dickinson Wright Lawyers Recognized in 2025 Northern California Super Lawyers, One Named Rising Star

- May 01, 2025 In the News Christopher Johnson and Bradley Wyatt co-authored an article, "Have you considered listing in London?" published by Laytons ETL Global.

- April 29, 2025 Articles Have You Considered London

- April 21, 2025 Media Mentions Frank Borger Gilligan was recently quoted in The Wall Street Journal, “Big Office Landlord Made $4 Million in Previously Undisclosed Payouts to Its CEO.”

- November 07, 2024 Recognition Congratulations to Jacob Frenkel, selected to the 2024 list of the “Securities Enforcement Elite” by Securities Docket.

- February 02, 2024 Industry Alerts CSA Adopts “Access Equals Delivery Model” for Reporting Issuer Prospectuses

- December 06, 2023 Industry Alerts Understanding the CSA’s Proposed Shelf Prospectus Regime for Well-Known Seasoned Issuers

- July 18, 2023 Video Minutes on the Matter with Frank Borger Gilligan: SEC v Ripple Labs, and What It Means for Digital Assets

- July 07, 2023 Industry Alerts Amendments to Canadian Securities Exchange Policies