Click “Subscribe Now” to get attorney insights on the latest developments in a range of services and industries.

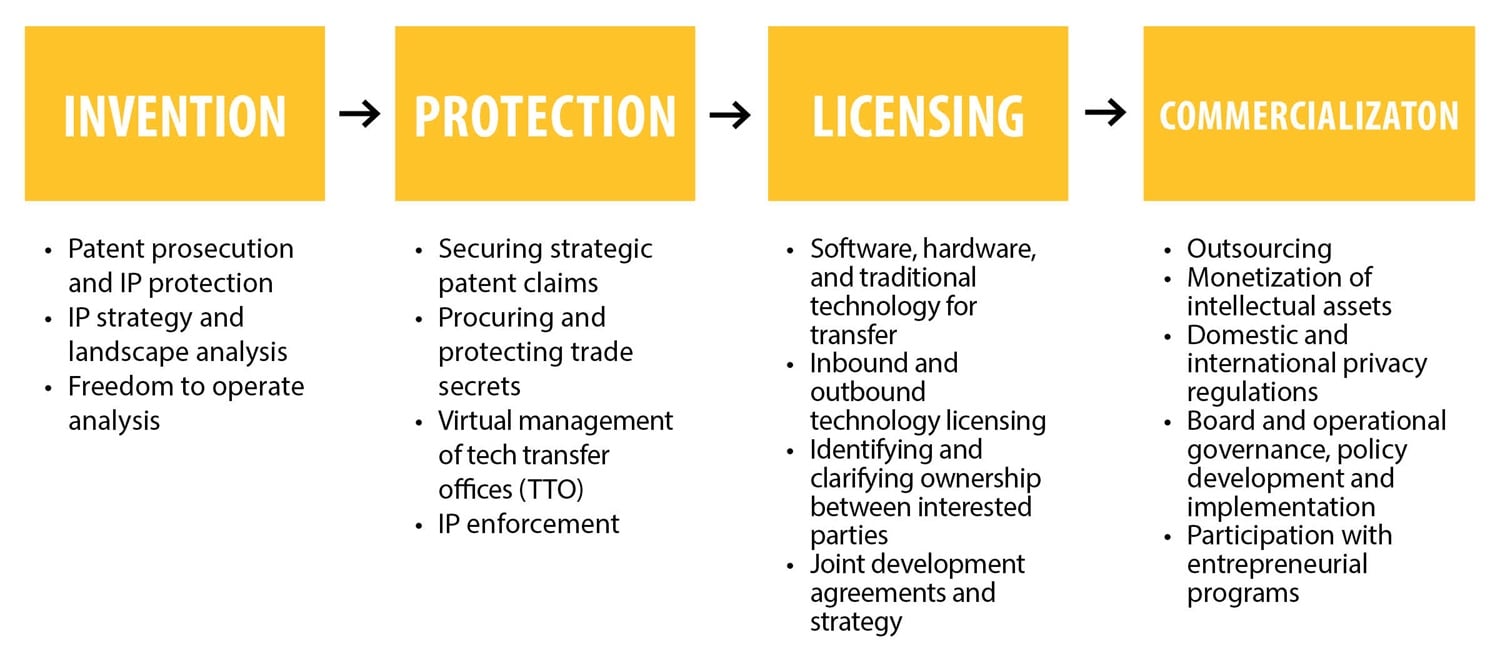

The technology transfer function within the academic and research-based ecosystem is crucial in converting modern advances into profitable business solutions. From traditional research and development to strategic exit, successful commercialization requires careful and precise execution within a heightened high risk/reward profile.

At Dickinson Wright, we take technology transfer further by revolutionizing within the innovation ecosystem itself. Through our decades of experience, we have gained the ability to look forward with our clients to create new commercialization possibilities that take advantage of trends in modern business.

Traditional Technology Transfer

Dickinson Wright has offered traditional technology transfer services for decades, working hand-in-hand with some of the largest universities, research institutions, and related spin-outs to turn inventions into profitable enterprises.

We recognize the importance of identifying and protecting innovations strategically at the earliest stage possible to help them reach their commercial potential and give our clients a competitive advantage.

Taking Technology Transfer to the Next Level

With traditional technology transfer firmly established in the innovation-sphere, Dickinson Wright works with clients to go beyond existing solutions by creating new ventures and structures that further develop and capitalize on modern innovations.

Examples of “Next Level” projects we have created with clients include:

Nonprofit/Research Park Structures: Leverage nonprofit models for utilization of governance structures to enable control while reducing risks related to both public and private institutions.

Commercialization Infrastructure Initiatives: Structure appropriate models for driving innovation toward desired objectives, including industry-specific initiatives, alumni bases, or market-driven opportunities.

Research Foundations: Identify opportunities and risks related to intellectual property ownership and asset management within or outside traditional institutional frameworks.

Seed & Venture Funds: Establish and manage internal, affinity, or independent funds for critical seed funding and other capital needs relating to the technology transfer functions.

Joint Ventures: Utilize well-established joint venture models for strategic initiatives and ventures to protect and leverage institutional upside relationships.

Master-Level Corporate Engagements: Leverage unique industry relationships to enable research funding and exit opportunities for developments related to certain fields or industries.